What is Manual Payment?

Steps to enable it?

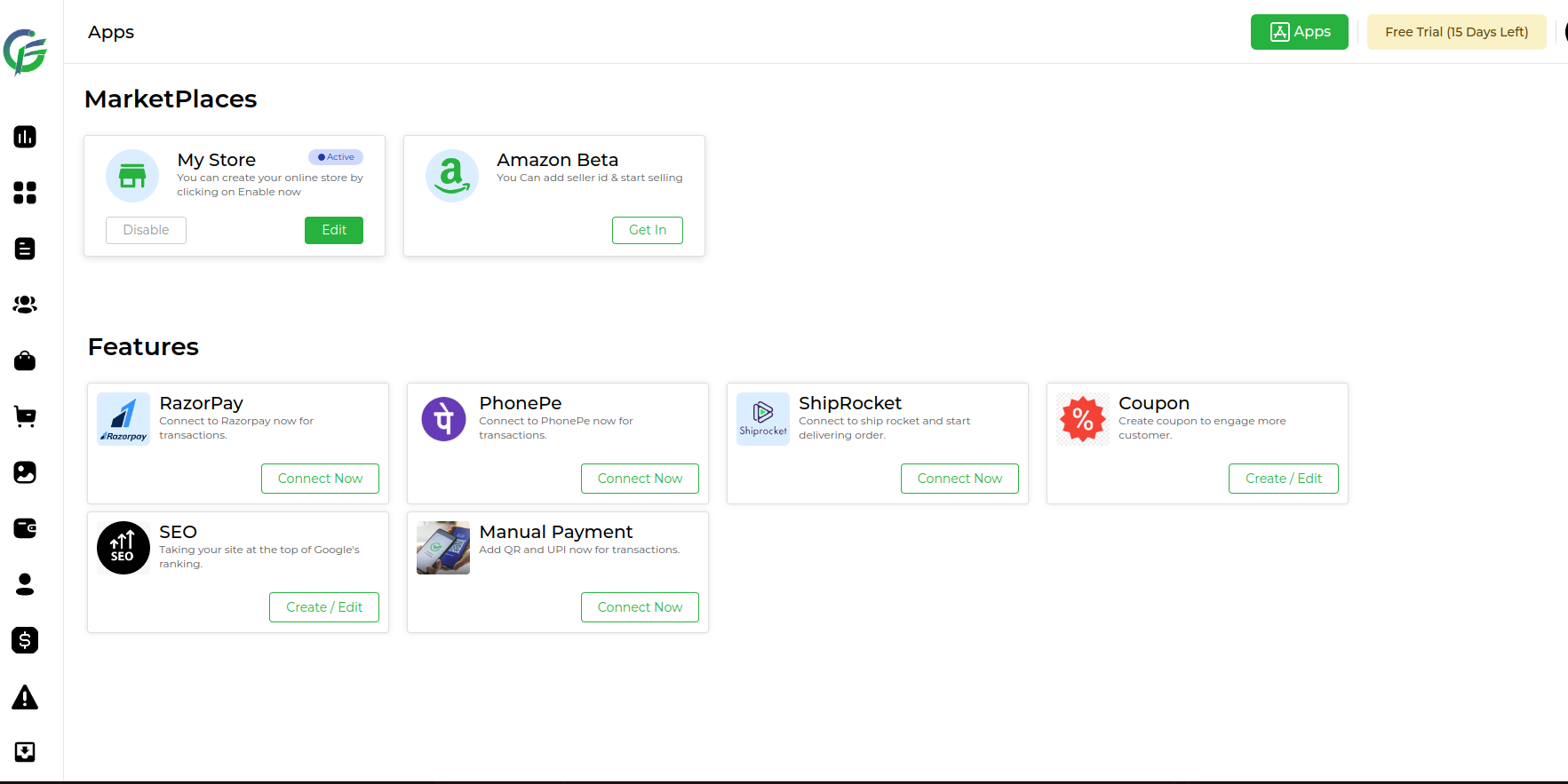

- Go to Apps: Go to apps where you can manage manual payment.

- Within the payment options, there should be a choice of payment methods. Look for an option related to manual payments or “Manual Payment Method.”

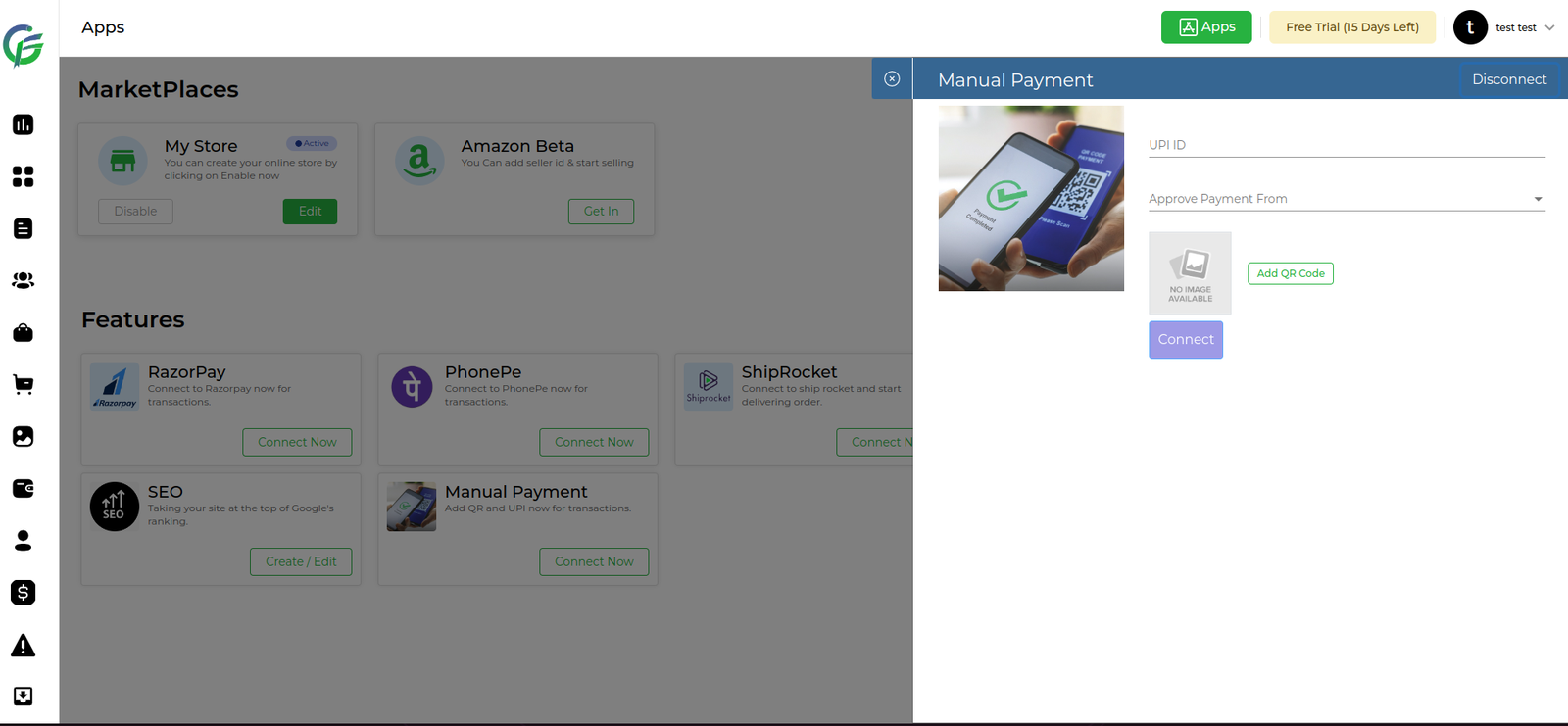

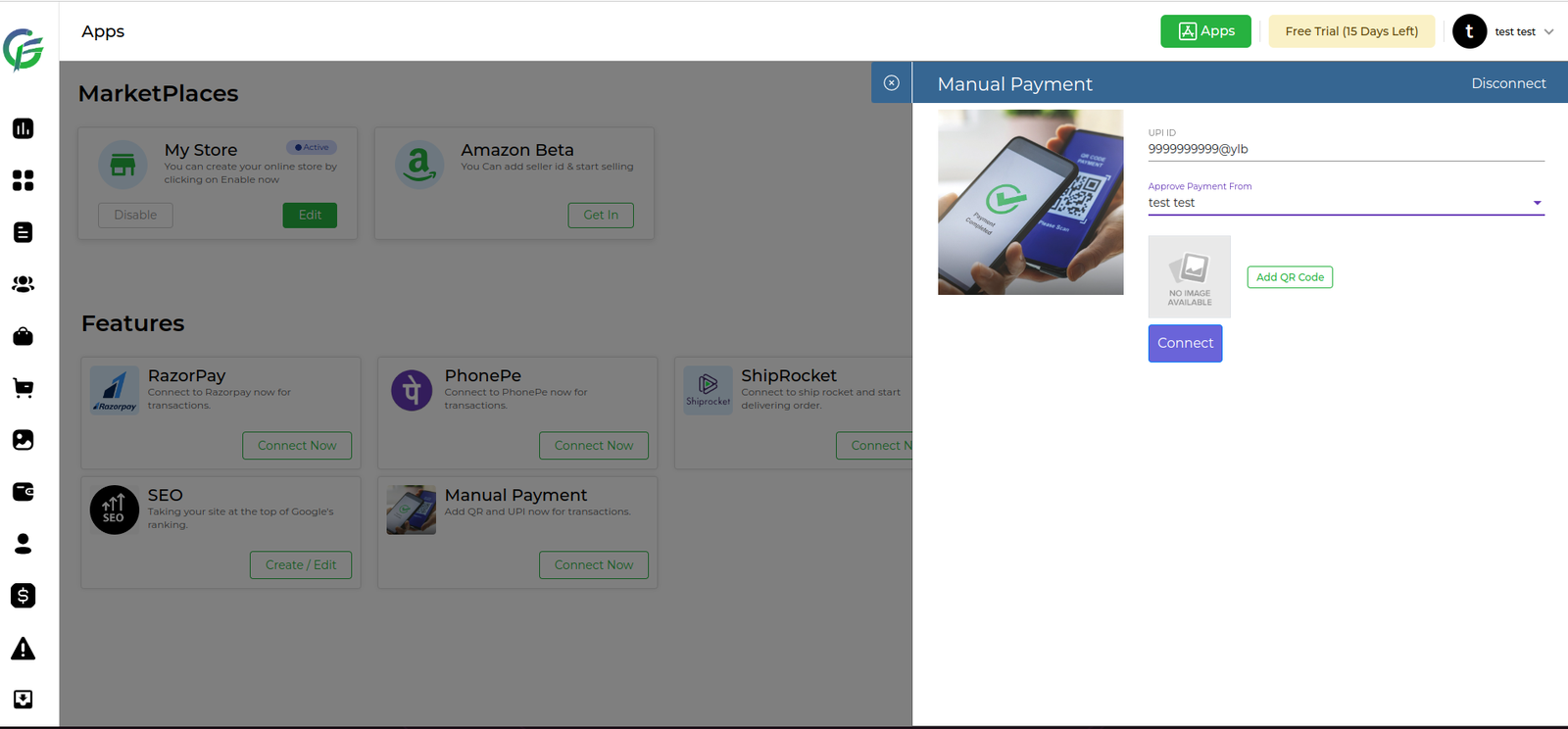

- Within the manual payment settings, there should be fields to specify UPI details. This typically includes:

- UPI ID: Enter the UPI ID associated with your account.

- QR Code Image: You have the option to upload a QR code image. If so, upload the UPI QR code image.

- Select Email for Payment Approval:

- Locate the field labeled “Approve Payment From”.

- Click on the dropdown arrow to open the list of available options.

- Scroll through the options and select “Email” from the dropdown menu. This indicates that payment approval notifications will be sent to the specified email address.

- After entering the UPI details, look for a “Save” or “Apply” button to confirm your manual payment settings.

How to use it?

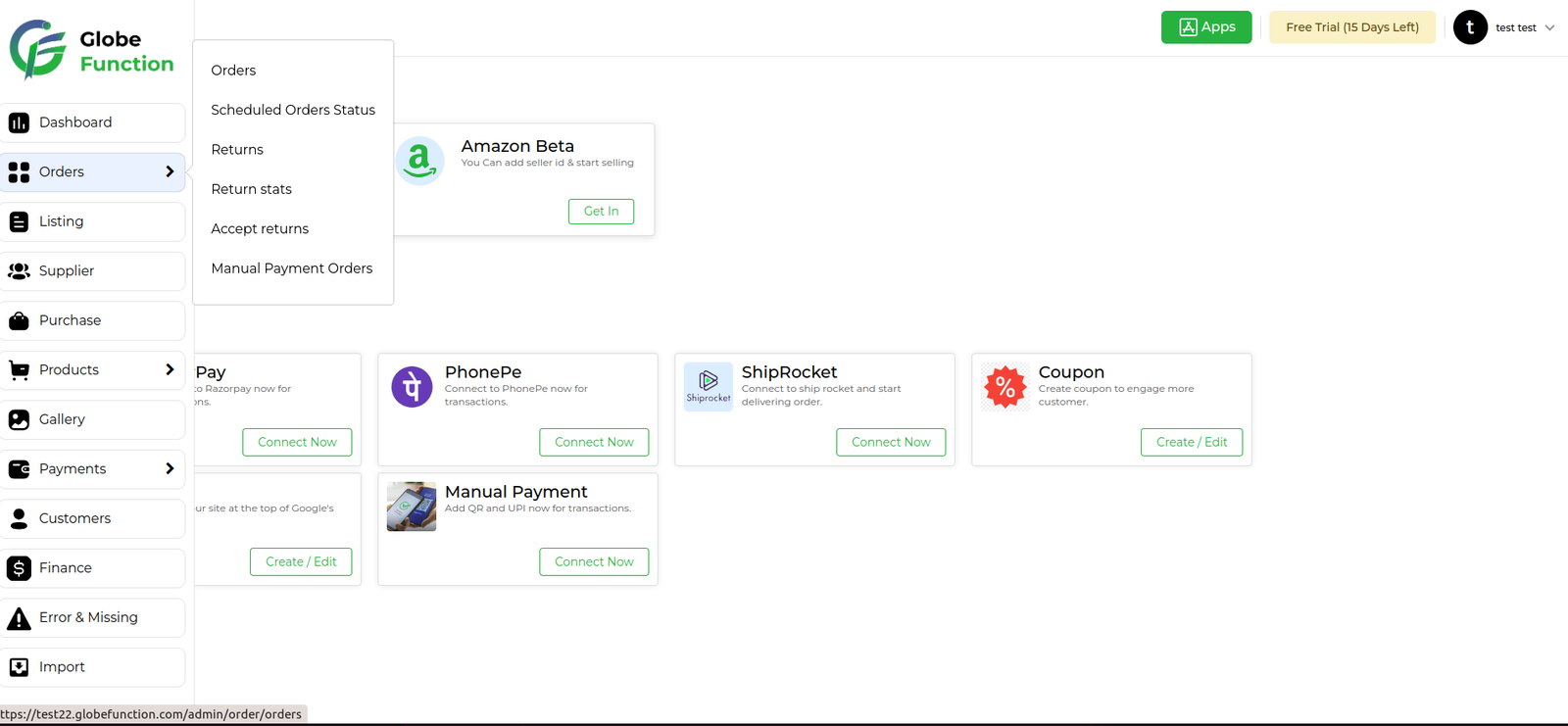

- Go to Orders> Manual Payment Orders :

- Look for a section within the order management area that lists all orders.

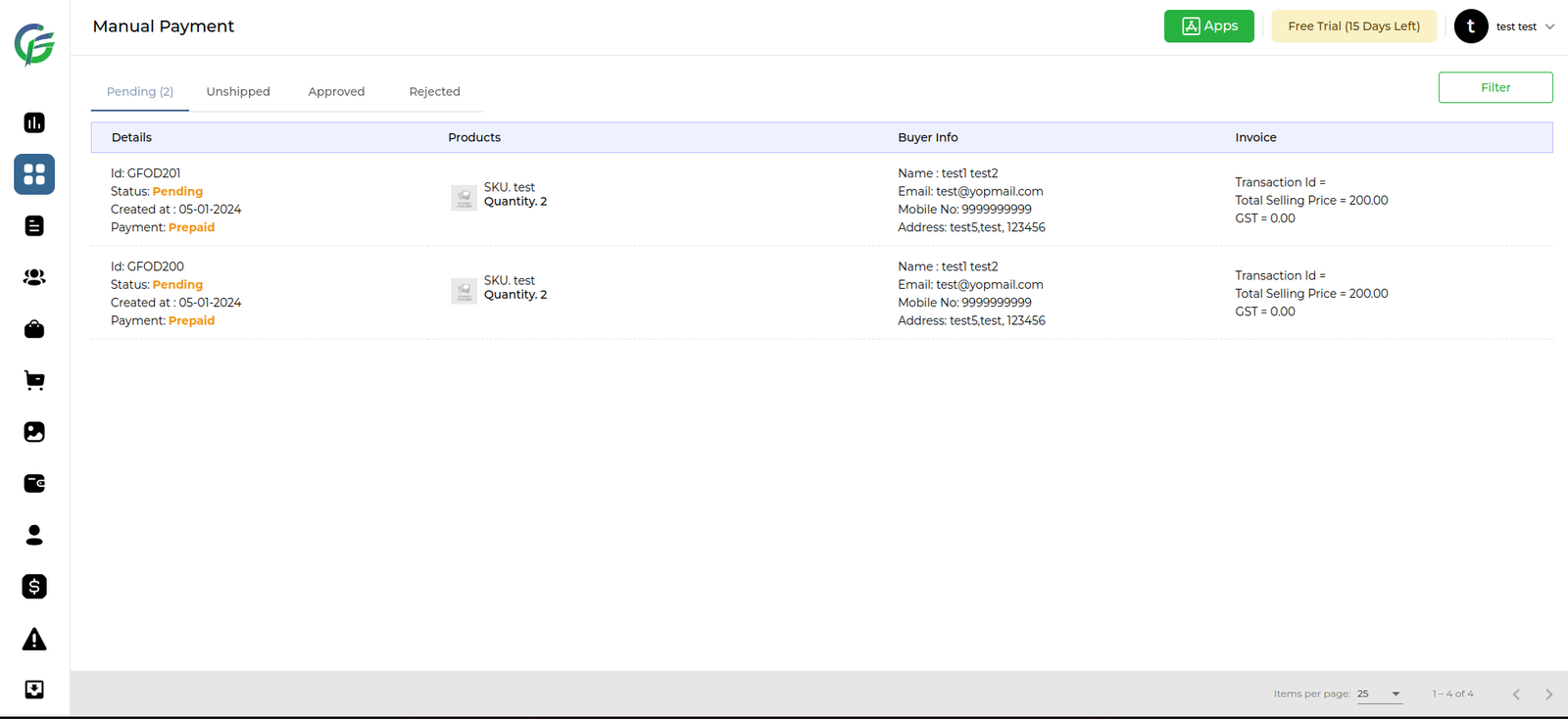

- Pending Section :

- orders which received from manual payment and the transaction ID field is empty or not entered by the customer.

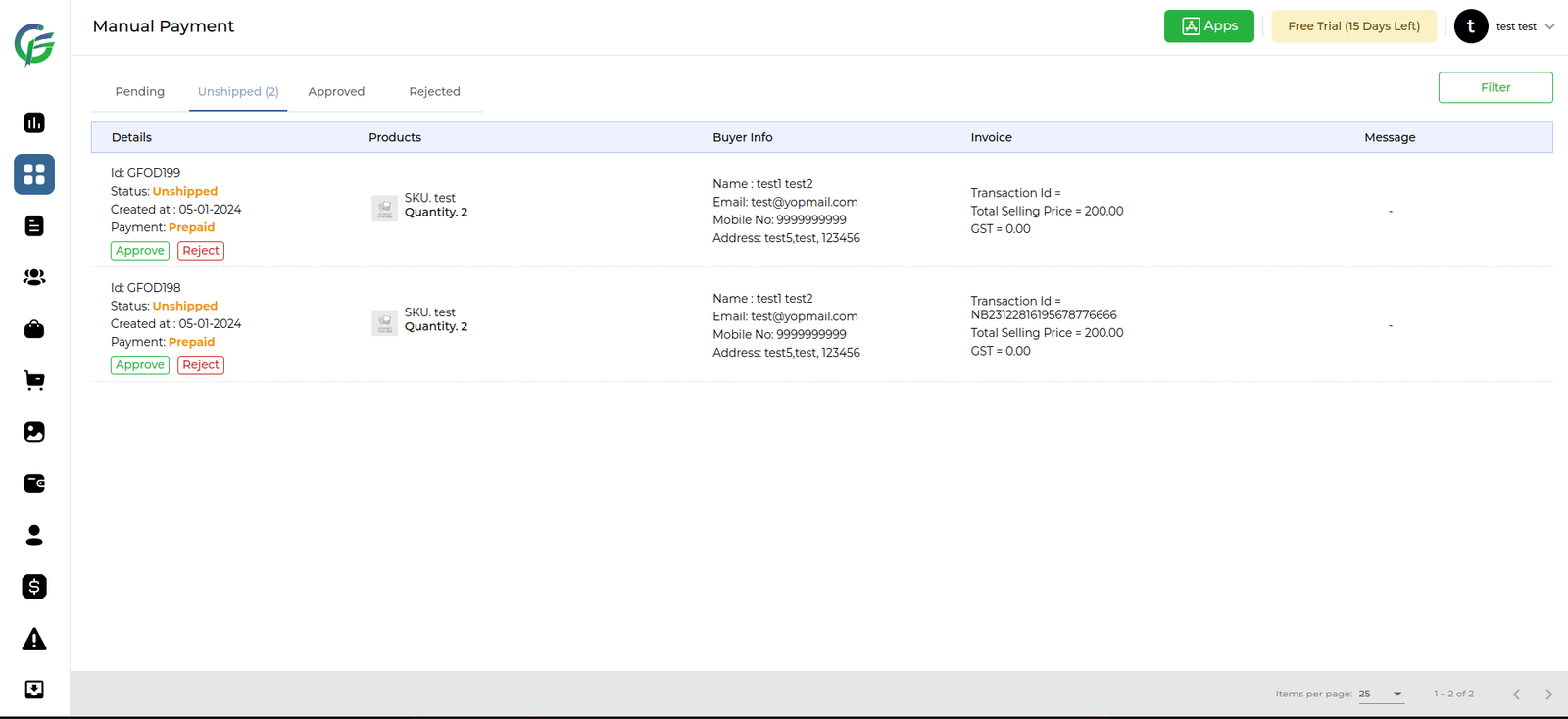

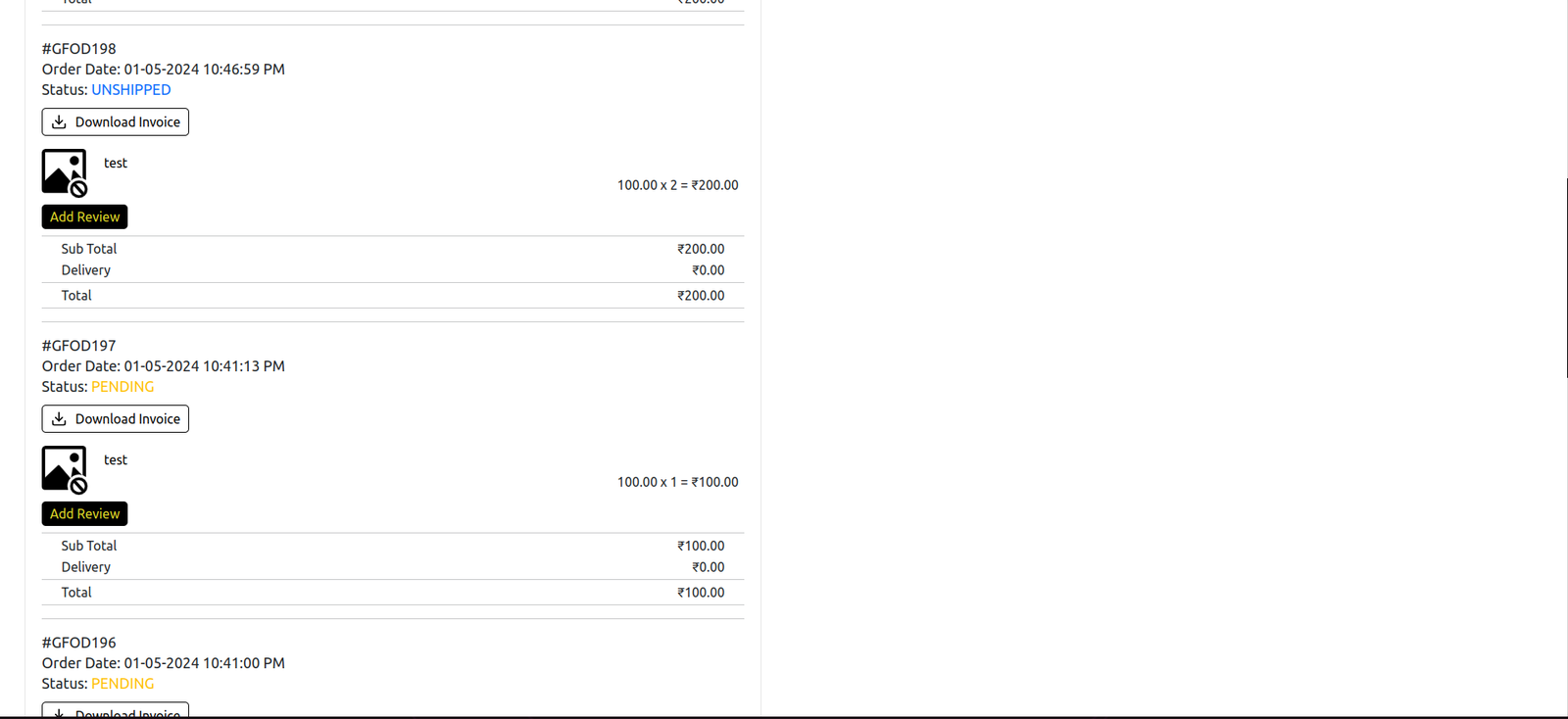

- Unshipped Orders :

- In the “Unshipped Orders” section, look for orders that are in a status indicating they require payment approval or rejection.

- Approve or Reject Payment:

- For each order requiring payment approval, there should be options to either approve or reject the payment. These options may be available as buttons or dropdown menu actions.

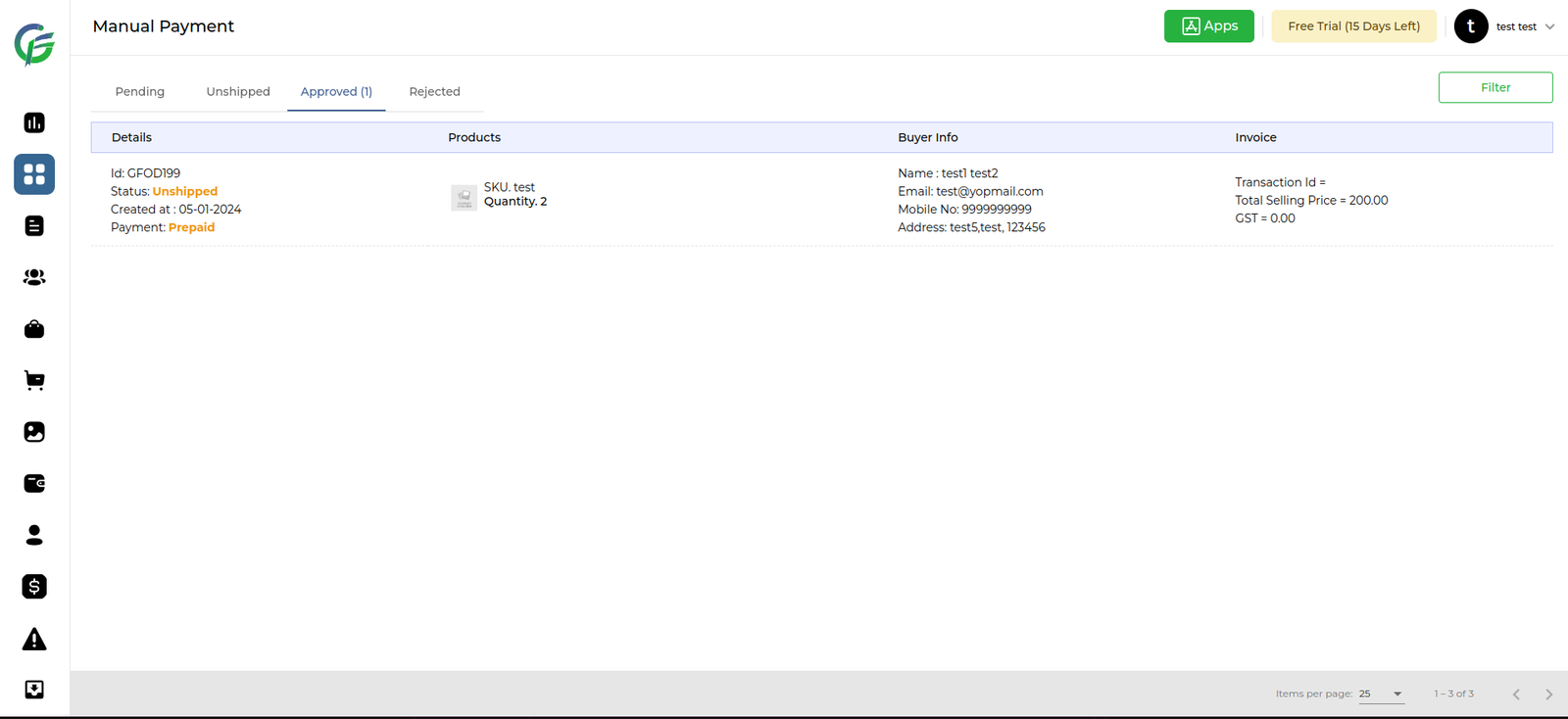

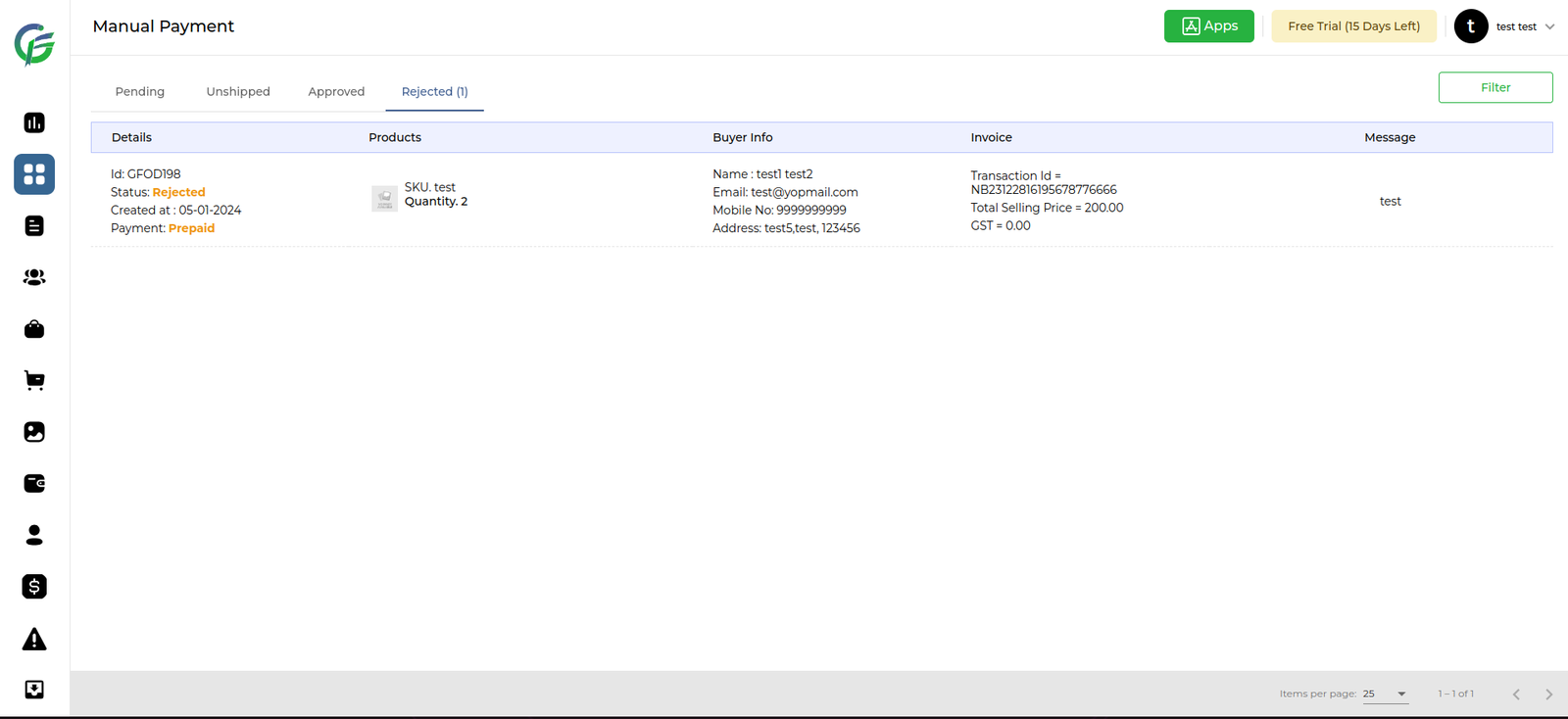

- Approved Payment :

- To view all approved orders where the user has approved payment.

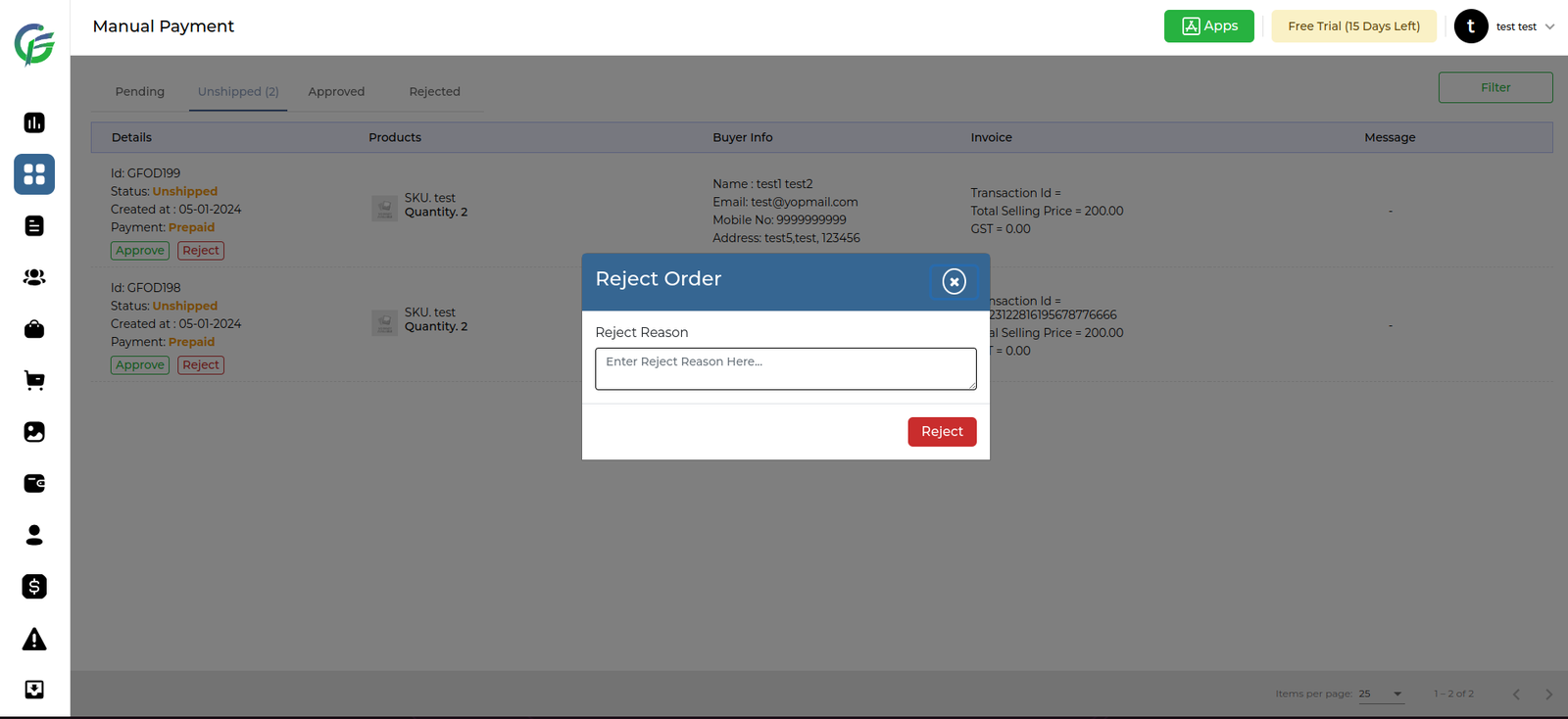

- Reject order :

- On the order details page, look for a button labeled “Reject” .

- After clicking the “Reject” button, a dialogue box or form may appear asking you to provide a reason for rejection. Enter the rejection reason in the provided field.

- Rejected order shows in Rejected Section.

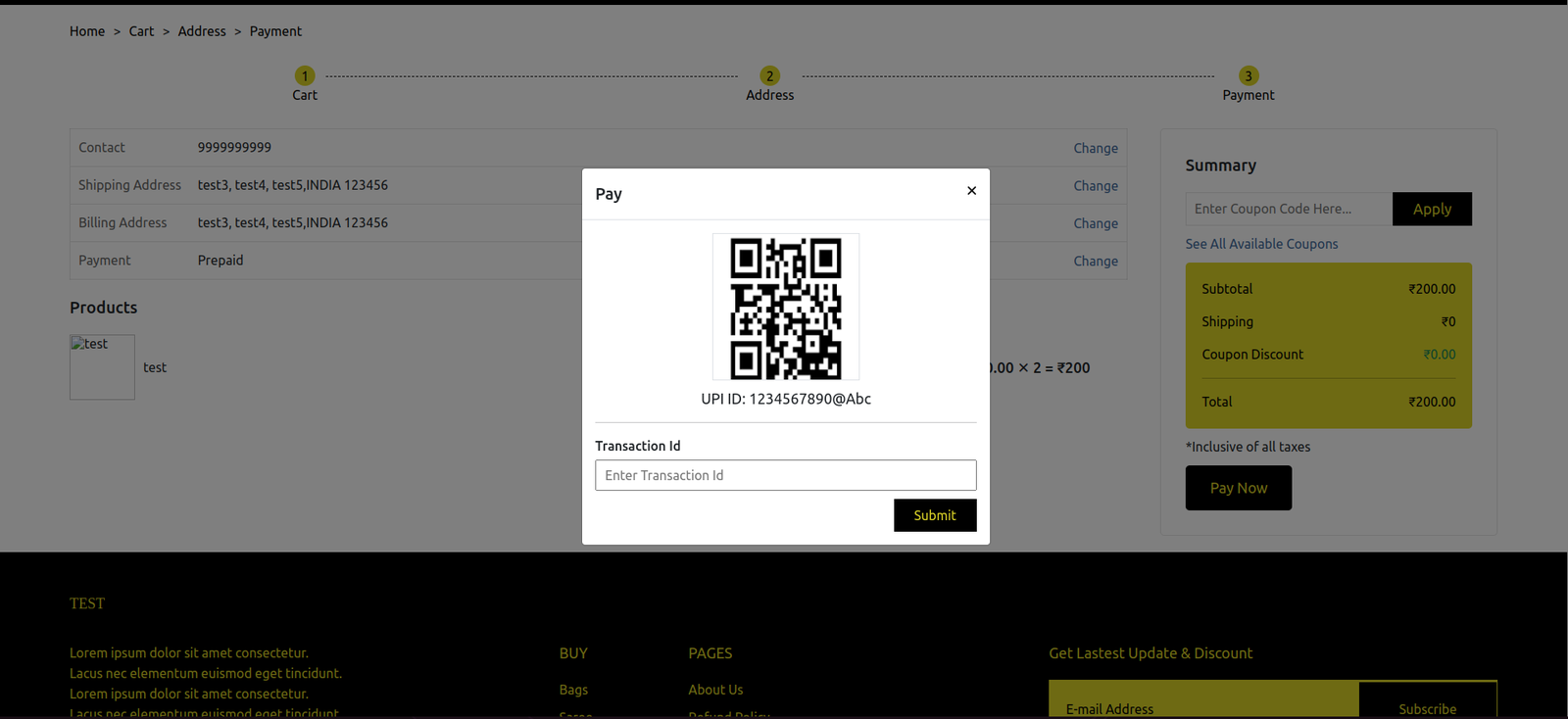

- Payment Page :

- Customer can done payment using Qr code or upi id

- customer can add transaction id and confirm order.

- customer can check order status in the manage order section

USE cases

- Some smaller businesses, particularly those in less technologically advanced regions, may not have the infrastructure or resources to set up payment systems. In such cases, transactions are often conducted using manual methods.

- In situations where an order confirmation is done manually , the customer may be provided with a UPI QR code to scan and make the payment. This could be applicable in cases where online payment links are not feasible.

- Some businesses may accept card payments in person without using a dedicated payment application.

A manual payment refers to a financial transaction that involves human intervention or physical handling rather than relying on automated systems.

Yes, certain online platforms may provide options for manual payments, such as entering bank details for a transfer or using QR codes for scanning and processing payments.

Yes, QR codes can be used in manual payments. For example, a user might scan a QR code provided by a business to make a payment using a mobile banking app or other payment methods.

- Reasons may include personal preferences, limited access to technology, lack of trust in electronic systems, or specific situations where traditional methods are more practical.

UPI (Unified Payments Interface) is a real-time payment system in India that enables users to link multiple bank accounts to a single mobile application. For manual payments on an e-commerce website, users can scan a UPI QR code or manually enter payment details to complete a transaction.

To make a manual payment, select the UPI or QR code option during the checkout process. Use your UPI-enabled app to scan the QR code or enter the payment details manually. Follow the instructions provided by the e-commerce website to complete the payment.

Generally, e-commerce websites do not charge additional fees for using UPI or QR code payments. However, it’s advisable to check the terms and conditions of the specific platform.